- Evaluating the impact of logistics networks on the distribution of ceramic products worldwide

Li Zhenga,* and Zhang Yihuab

aSchool of Transportation and Logistics of Guangzhou Railway Polytechnic, Guangzhou, Guangdong 511300, China

bGuangzhou Hualong Motor Transport Co., Ltd, Guangzhou, Guangdong 511300, ChinaThis article is an open access article distributed under the terms of the Creative Commons Attribution Non-Commercial License (http://creativecommons.org/licenses/by-nc/4.0) which permits unrestricted non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited.

The presence and diversity of ceramic goods, spanning from conventional home items to sophisticated technical ceramics, are progressively influenced by the dynamics of global logistics systems. This research explores the impact of global transportation systems, supply chain robustness, and trade dynamics on regional availability of ceramic products in various markets. The research integrates quantitative trade information with qualitative perspectives from industry stakeholders to outline the supply chain routes of ceramic products and pinpoint essential logistical bottlenecks and facilitators. The study examines international trade data from the UN Comtrade and ITC databases, concentrating on import and export movements of ceramic tiles, sanitary ware, and advanced ceramics. Simultaneously, discussions with distributors and ceramic sellers across Asia, Europe, Africa, and Latin America provide practical insights into shipping holdups, storage limitations, and how local infrastructure affects product diversity. Case studies illustrate how regional logistics strengths like port effectiveness, transport systems, and customs processes directly impact market variety and consumer accessibility. Results indicate that although logistics centers and efficient trade agreements improve product variety and cost-effectiveness, areas with inferior infrastructure experience restricted access, elevated costs, and reduced product turnover. The research concludes by suggesting methods to decentralize ceramic production, improve last-mile logistics, and foster fairer distribution networks.

Keywords: Ceramic products, International trade in ceramics, Regional trade disparities.

Ceramic materials, known for their exceptional versatility and performance attributes, support a wide range of human activities, blending effortlessly into traditional crafts and advanced technologies [1]. From the common use of tableware and their essential function in construction as tiles and sanitary items, to their vital roles in sophisticated electronics, the rigorous settings of aerospace engineering, and the vital infrastructure of energy production, ceramic products are intrinsically integrated into the essence of contemporary life [2]. As the global demand for these materials rises, driven by urbanization, technological advances, and changing consumer tastes, their accessibility and abundance in various geographical areas are more and more influenced by the complex operations of international logistics systems [3].

Despite considerable academic focus and industrial innovation aimed at progress in ceramic material science, new manufacturing methods, and the creation of targeted applications, the essential influence of supply chain design and logistics systems on regional access to this varied product range remains a relatively overlooked, yet significantly important aspect [4]. Global logistics networks embody a complex and ever-changing system, involving an intricate interaction of production centers located in various regions, multiple modes of transport (maritime, air, and land), a network of global trade regulations and policies, and diverse distribution pathways that together facilitate the transport of ceramic goods from their source to their ultimate destination [5].

In this complex system, a variety of logistical factors have significant impact. Elements like the availability and effectiveness of port facilities, the intricacies and durations of customs clearance processes, the variable expenses tied to freight and storage, and the general dependability and swiftness of transportation services can individually and collectively influence the overall cost, the range of options provided, and the reliability of delivery schedules for ceramic products arriving in various markets [6]. As a result, areas with advanced logistics systems, strategically aligned trade relationships, and efficient regulatory frameworks typically enjoy a broader and more accessible range of ceramic goods, often at more favorable prices [7]. On the other hand, regions marked by infrastructure constraints, logistical challenges, or unfavorable trading conditions might face limited access to specific product types, endure extended restocking periods that result in shortages, and consequently confront a reduced variety in the ceramic products available to their industries and consumers [8-12].

Acknowledging the vital link between global logistics and regional market results, this study aims to deliver a thorough analysis of how the framework and operational effectiveness of international logistics systems impact the accessibility and diversity of ceramic products in various geographical and economic areas. This study seeks to elucidate the intricate interactions between evolving supply chain processes and measurable market results by systematically combining quantitative assessments of global trade data, covering import/export volumes, product categories, and trade patterns, with detailed qualitative insights obtained from interviews and surveys of critical industry participants, such as ceramic producers, global distributors, logistics providers, and retailers. The results produced by this study are expected to provide fresh and useful insights for various stakeholders, such as policymakers wanting to promote increased supply chain fairness and resilience, ceramic producers looking to improve their global distribution approaches, and logistics companies seeking to reduce bottlenecks and boost service effectiveness. Ultimately, this research aims to enhance the comprehension of the logistical foundations of the global ceramic market, facilitating approaches that encourage more equal and fair access to these vital materials globally.

This research utilizes a mixed-methods strategy to examine how global logistics networks affect the accessibility and diversity of ceramic products in various areas. The research framework is organized into three stages: quantitative assessment of worldwide trade statistics, qualitative discussions with industry participants, and comparative case studies from different regions. This framework facilitates a thorough comprehension of the relationship between logistical infrastructure and the distribution of ceramic products. Quantitative data was gathered from the UN Comtrade Database and the International Trade Centre (ITC) Trade Map, concentrating on particular Harmonized System (HS) codes associated with ceramic items. This encompasses ceramic tiles (HS 6907, 6908), sanitary ware (HS 6910), and technical ceramics (HS 6903, 6909). Data from 2015 to 2023 were examined to uncover patterns in import and export quantities, trading partners, trade values, and regional dependencies. To evaluate the logistics landscape, the World Bank's Logistics Performance Index (LPI) was utilized to measure national performance on factors like infrastructure quality, customs effectiveness, reliability of international shipments, and capacity of port handling. To supplement the quantitative data, semi-structured interviews were carried out with important stakeholders in the ceramic supply chain. This group consisted of ten ceramic distributors and retailers, five import/export managers from ceramic production companies, and five logistics experts involved in freight forwarding and port operations. The interview questions aimed to gather insights on actual supply chain issues, shipping expenses, delivery delays, and the perceived effects of logistics efficiency on the variety of ceramic offerings in local markets. The thematic analysis of the qualitative data revealed patterns and regional differences. Moreover, four areas were chosen for detailed case studies: Sub-Saharan Africa, Southeast Asia, Europe, and South America. These areas were selected due to differing logistics performance levels and varying reliance on ceramic imports. Each case study considered factors such as import profiles, the range of available ceramic products, average lead times, and specific logistics constraints reported by stakeholders.

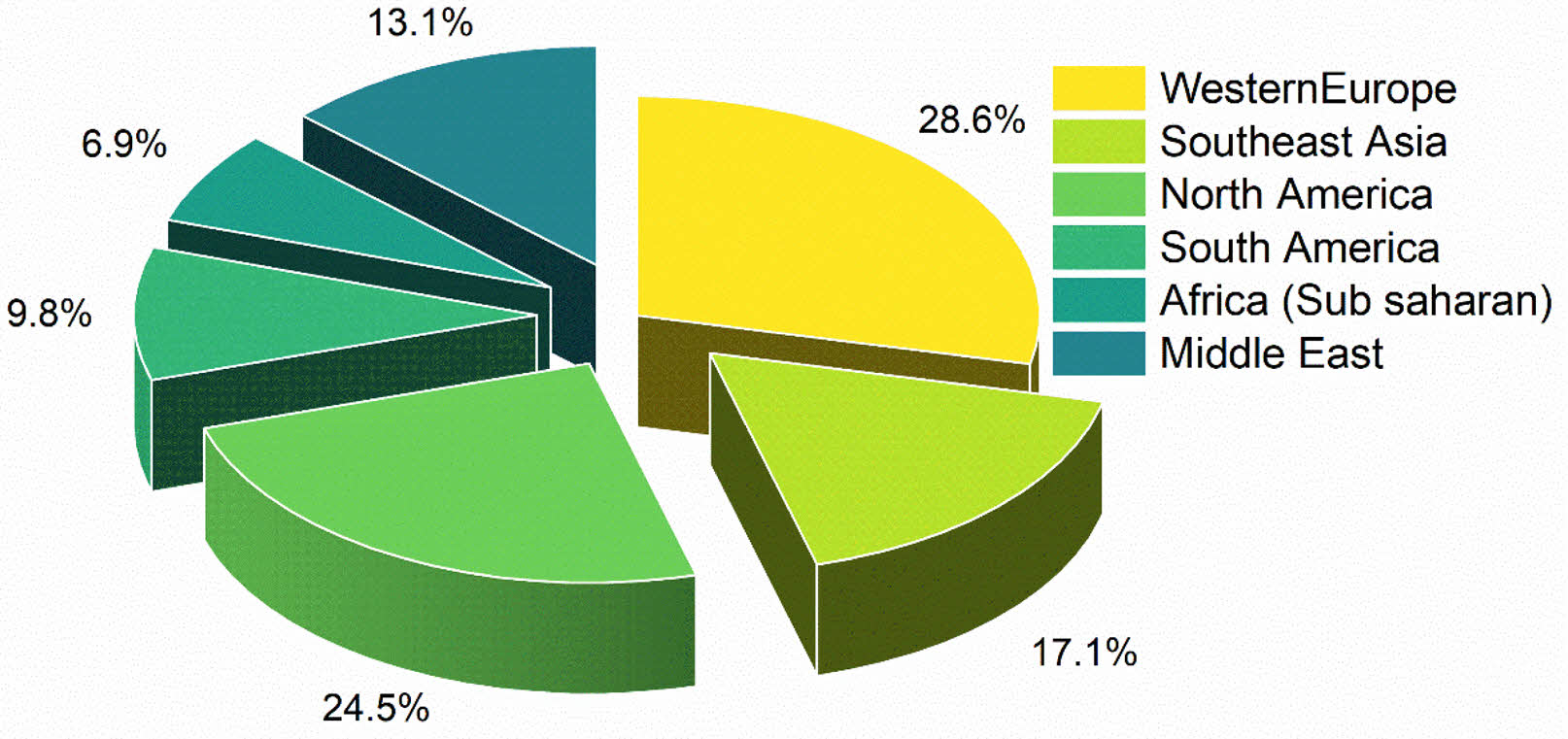

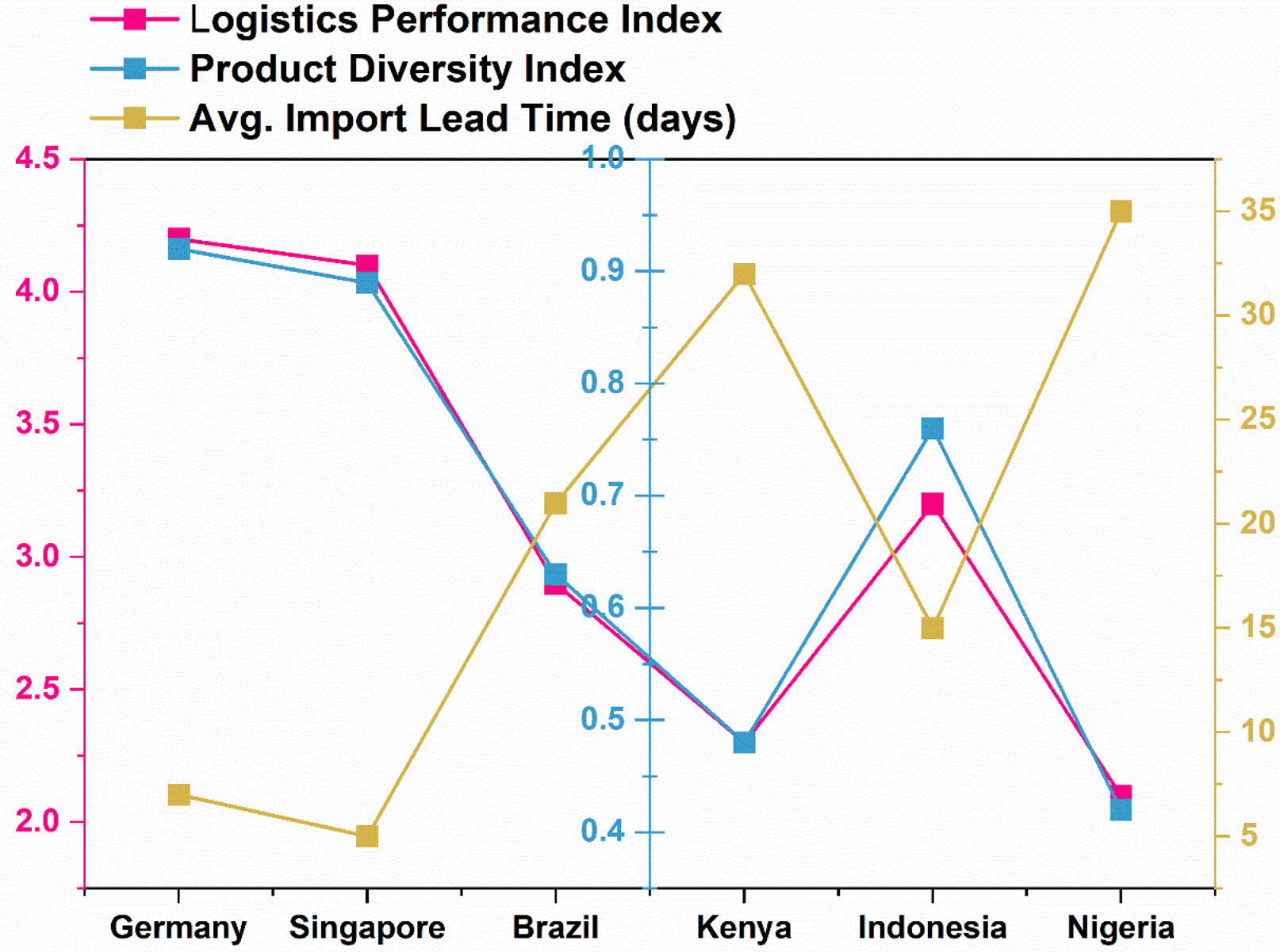

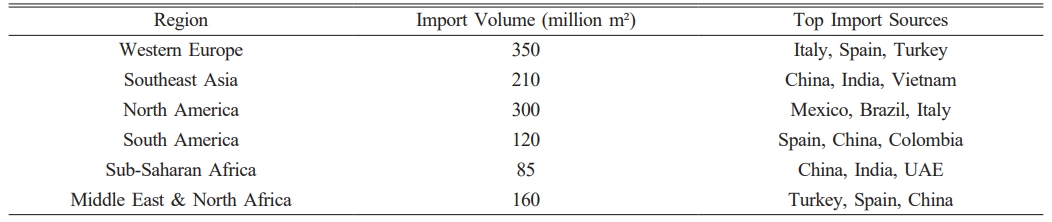

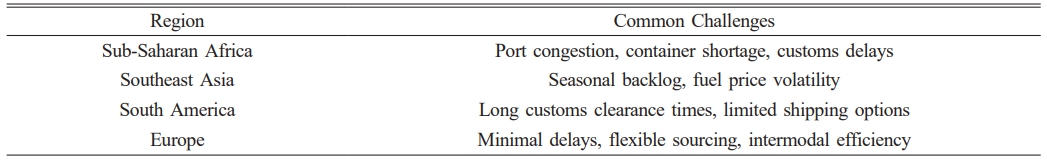

The results of this research demonstrate a distinct connection between global logistics effectiveness and the regional access to and diversity of ceramic items. Examination of international trade statistics from 2015 to 2023 revealed that areas with elevated LPI ratings, like Western Europe, East Asia, and certain regions of North America, consistently exhibited increased import quantities and a wider variety of ceramic items (Table 1 and Fig. 1). For example, nations such as Germany, the Netherlands, Singapore, and South Korea not only import substantial amounts of ceramic tiles and sanitaryware but also showcase considerable product diversity acquired from various countries like Italy, China, Spain, and Turkey. These areas enjoy effective port facilities, sophisticated inventory control systems, and reduced customs hold-ups, enabling distributors to supply a diverse array of ceramic styles, dimensions, and technical features. In contrast, areas with lower LPI scores, like Sub-Saharan Africa and sections of South America, showed a restricted variety of ceramic imports, frequently depending on a limited number of supplier nations (Table 2). Discussions with importers in these areas revealed ongoing issues such as prolonged shipping delays, elevated freight charges, limited port capacity, and inefficiencies in customs. For instance, ceramic suppliers in Nigeria and Kenya noted that shipping lead times frequently exceed 60 days, leading to diminished inventory turnover and reduced product variety in the market. Additionally, the expenses related to transportation and storage were discovered to considerably raise the final retail costs of ceramic items, rendering high-end or specialized products less available to buyers in these areas (Fig. 2).

Insights from stakeholders highlighted the influence of logistics disruptions on the diversity of products. Interviewees from Southeast Asia mentioned that robust port links and consistent shipping timetables facilitated rapid product replacement and the capacity to adjust to shifting consumer demands. Conversely, South American importers indicated that recent rises in fuel prices, shortages of containers, and shipping delays, aggravated by global occurrences like the COVID-19 pandemic—compelled numerous suppliers to limit the variety of ceramic product lines offered for import. These limitations impacted not just the availability of aesthetic options such as color, texture, and finish, but also restricted access to technical ceramics utilized in industrial applications.

The regional case studies offered a detailed perspective on how logistics infrastructure influences market variety. Chesive supply chain of Europe, bolstered by trade agreements and diverse transport modes, has enabled a diverse range of ceramic products, even in lesser markets. Conversely, reliance of Sub-Saharan Africaon far-off suppliers and absence of containerized inland transport alternatives has led to reduced consumer options and increased price fluctuations [12]. The results indicate that logistical constraints worsen trade disparities, as areas lacking proper infrastructure tend to attract fewer suppliers and struggle to sustain competitive pricing.

In summary, this research verifies that the robustness and endurance of worldwide logistics networks are crucial factors influencing the availability and variety of ceramic products in different regions. Effective logistics enhance accessibility, foster adaptability to market needs, facilitate competitive pricing, and minimize waste by optimizing supply chain management. On the other hand, logistical shortcomings can hinder market expansion, reduce consumer options, and boost dependence on inexpensive, limited-variety imports. These insights hold significant consequences for ceramic producers, policymakers, and supply chain strategists. Funding for upgrading ports, automating customs processes, and enhancing regional trade could aid in tackling current inequalities and fostering fairer access to ceramic goods globally. Moreover, decentralized storage and local manufacturing collaborations could provide enduring solutions to alleviate the impacts of global supply chain disturbances on the ceramics industry.

|

Fig. 1 Regional distribution of ceramic tile imports in 2022 (in million m²). The pie chart illustrates the proportion of global ceramic tile imports accounted for by six major regions, highlighting Western Europe and North America as leading importers, followed by Southeast Asia and other emerging markets. |

|

Fig. 2 The figure shows the total ceramic tile imports (in million m²) for six global regions, indicating Western Europe and North America as dominant markets, while Sub-Saharan Africa shows the lowest import volume, reflecting differences in market size, demand, and logistics infrastructure. |

This research has investigated the essential function of international logistics networks in influencing the local accessibility and assortment of ceramic items. By analyzing trade data, conducting stakeholder interviews, and examining regional case studies, it was determined that logistics performance, assessed by infrastructure quality, shipping efficiency, and customs processes, directly affects the variety and availability of ceramic products in various markets. Areas with strong logistics systems, like Europe and certain Southeast Asian regions, enjoy increased product variety, quicker restocking times, and reduced shipping expenses. These benefits allow suppliers to satisfy varied consumer needs and react swiftly to shifts in the market. In comparison, regions with logistical shortcomings, such as Sub-Saharan Africa and some South American nations, encounter few import alternatives, extended shipping delays, and high expenses, thereby limiting consumer options and exacerbating price differences. The results highlight that boosting logistics capacity is crucial not only for increasing trade efficiency but also for guaranteeing fair access to ceramic goods globally. Policymakers and industry leaders need to view logistics as an essential element in the overall strategy for market growth in the ceramic industry. Focused investments in upgrading ports, automating customs, and enhancing regional transport corridors can assist in closing the accessibility divide between high- and low-performing areas. Moreover, promoting regional manufacturing hubs and implementing decentralized distribution strategies could provide robust options in response to global supply chain challenges. This study emphasizes the connection between ceramics and logistics, enhancing the understanding of how availability of materials is affected by wider infrastructural and policy systems. Future research may build on this study by exploring particular product categories (e.g., advanced ceramics), assessing changes in global logistics strategies after the pandemic, or analyzing the environmental effects of transporting ceramics over long distances.

- 1. P.K. Bagchi, Logist. Inf. Manag. 10[1] (1997) 28-39.

-

- 2. O. Carranza, M. Arnold, and J.P. Antún, Int. J. Phys. Distrib. Logist. Manag. 32[6] (2002) 480-496.

-

- 3. G. Chow, T.D. Heaver, and L.E. Henriksson, Logist. Transp. Rev. 31[4] (1995) 285-293.

- 4. E. Hartmann and A. De Grahl, J. Supply Chain Manag. 47[3] (2011) 63-85.

-

- 5. Y. Sumantri, F. Gapsari, G. Hadiko, and V.P. Pramuditha, J. Distrib. Sci. 20[6] (2022) 87-97.

-

- 6. C.C. Defee and B.S. Fugate, Int. J. Logist. Manag. (2010) 21[2] 180-206.

-

- 7. L. Cui and S. Hertz, Ind. Mark. Manag. 40[6] (2011) 1004-1011.

-

- 8. A. Halldorsson and T. Skjott-Larsen, Int. J. Oper. Prod. Manag. 24[2] (2004) 192-206.

-

- 9. X. Liu, D.B. Grant, A.C. McKinnon, and Y. Feng, Int. J. Phys. Distrib. Logist. Manag. 40[10] (2010) 847-866.

-

- 10. N. Normal, Int. J. Econ. Financ. Issues 9[2] (2019) 24-31.

-

- 11. M.C. Tsai, K. Lai, A.E. Lloyd, and H.J. Lin, Transp. Res. E Logist. Transp. Rev. 48[1] (2012) 178-189.

-

- 12. M.A.A. Zubayer, S.M. Ali, and G. Kabir, J. Model. Manag. 14[3] (2019) 792-815.

-

This Article

This Article

-

2025; 26(2): 257-260

Published on Apr 30, 2025

- 10.36410/jcpr.2025.26.2.257

- Received on Dec 17, 2024

- Revised on Apr 11, 2025

- Accepted on Apr 11, 2025

Services

Services

Shared

Correspondence to

Correspondence to

- Li Zheng

-

School of Transportation and Logistics of Guangzhou Railway Polytechnic, Guangzhou, Guangdong 511300, China

Tel : +86 13610356898 - E-mail: Lzzsl85475@163.com

Copyright 2019 International Orgranization for Ceramic Processing. All rights reserved.

Copyright 2019 International Orgranization for Ceramic Processing. All rights reserved.